Receiving a Summons and Complaint from a creditor, or being threatened with a judgment can be scary, but what does it really mean for you financially? This is a question that a lot of potential clients have when we first meet. Please read on to find out more!

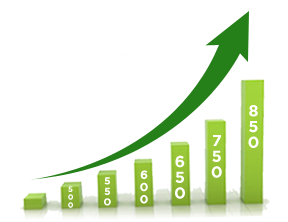

What Does it Mean When a Creditor Gets a Judgment Against Me?

Receiving a Summons and Complaint from a creditor, or being threatened with a judgment can be...