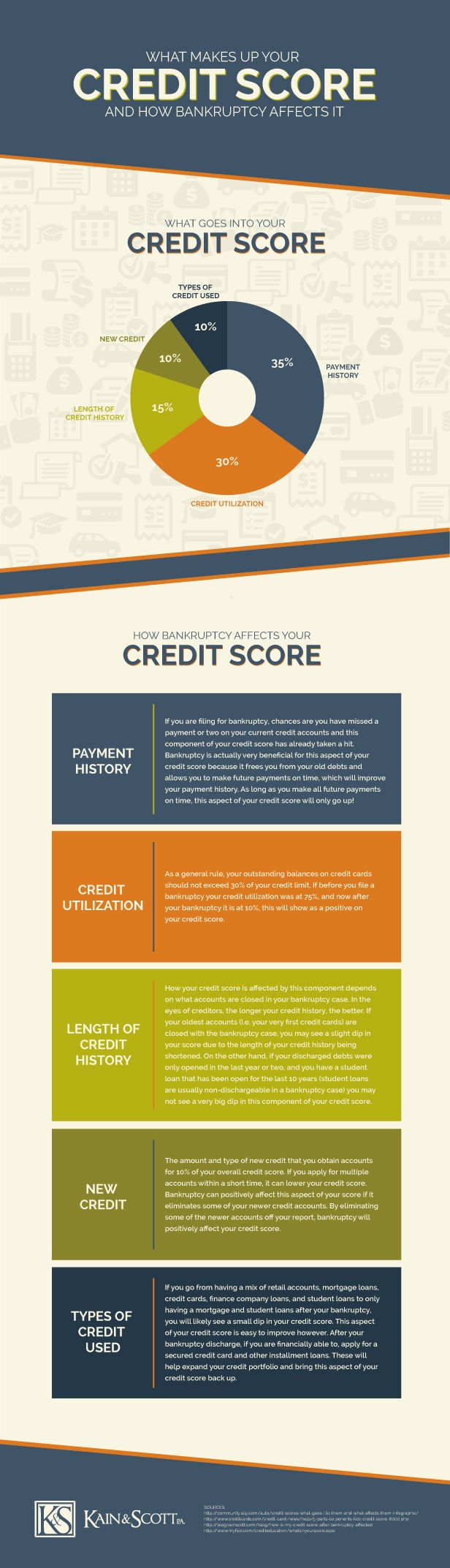

You may think that your credit union is the same as a typical bank, and in many respects, it is; but, there are some differences. For example, your credit union is a nonprofit, whereas a bank like Huntington Bank, is for profit.

Your Credit Union and Bankruptcy

You may think that your credit union is the same as a typical bank, and in many respects, it is;...